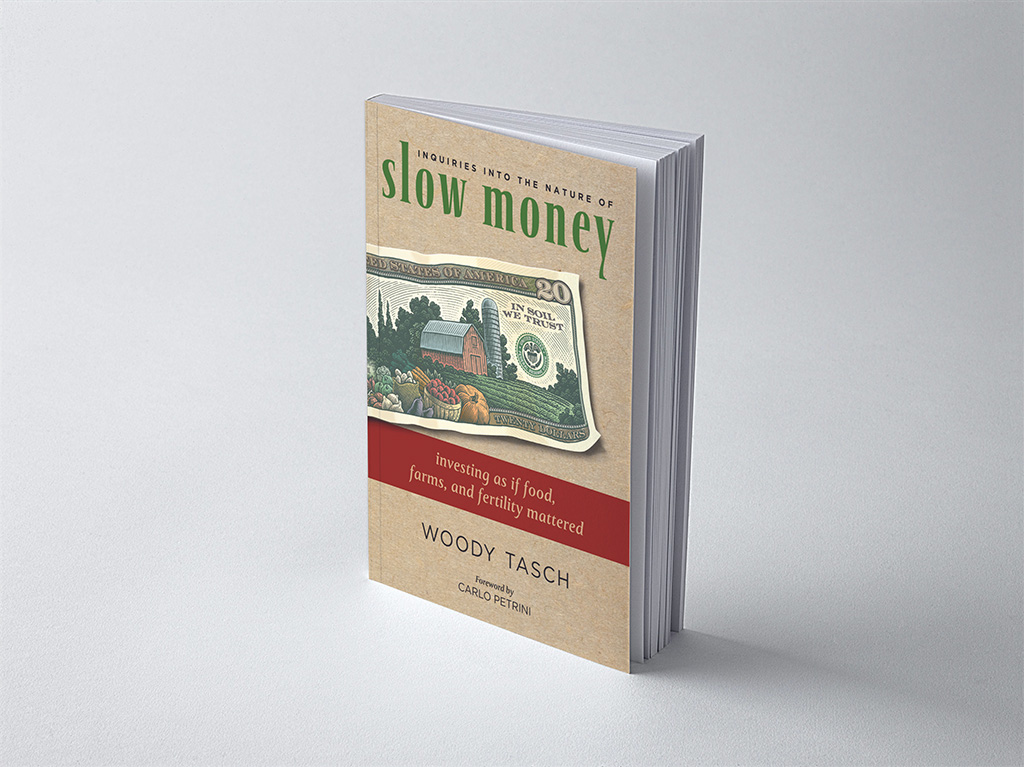

Inquiries into the Nature of Slow Money

Woody Tasch

$21.95

Could there ever be an alternative stock exchange dedicated to slow, small, and local? Could a million American families get their food from CSAs? What if you had to invest 50 percent of your assets within 50 miles of where you live? Such questions represent the first steps on our path to a new economy.

About Woody Tasch

Woody Tasch is the author of Inquiries into the Nature of Slow Money: Investing as if Food, Farms, and Fertility Mattered (Chelsea Green), SOIL: Notes Towards the Theory and Practice of Nurture Capital (Slow Money Institute), and AHA!: Fake Trillions, Real Billions, Beetcoin and the Great American Do-Over (Slow Money Institute). Tasch is former chairman of Investors’ Circle, a nonprofit angel network that has facilitated more than $200 million of investments in over 300 early-stage, sustainability-promoting companies. As treasurer of the Jessie Smith Noyes Foundation in the 1990s, he was a pioneer of mission-related investing. He was founding chairman of the Community Development Venture Capital Alliance. Utne Reader named him “One Of 25 Visionaries Who Are Changing Your World.”

Testimonials

Gregory Whitehead, Treasurer, The Whitehead Foundation

Indispensable reading, to be placed on the same shelf as Wendell Berry and E.F. Schumacher.

Steve Costa, Point Reyes Books

This book is going to unleash a major movement in this country.